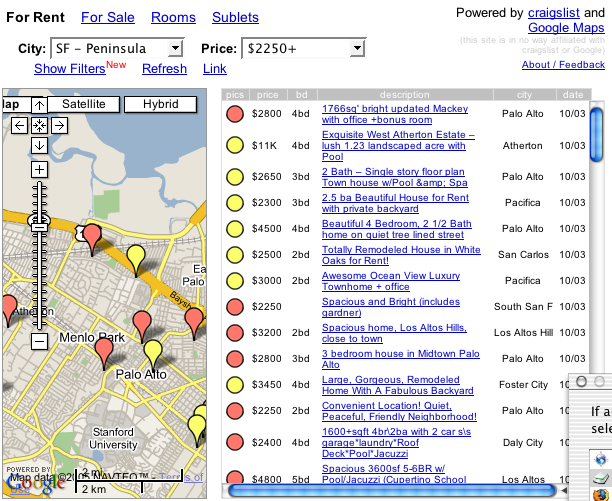

Housing Map

Housing Maps

the criagslist - googlemap mash up.

See also housing maps by census.

via

link paul k @inf greed

« August 2005 | Main | October 2005 »

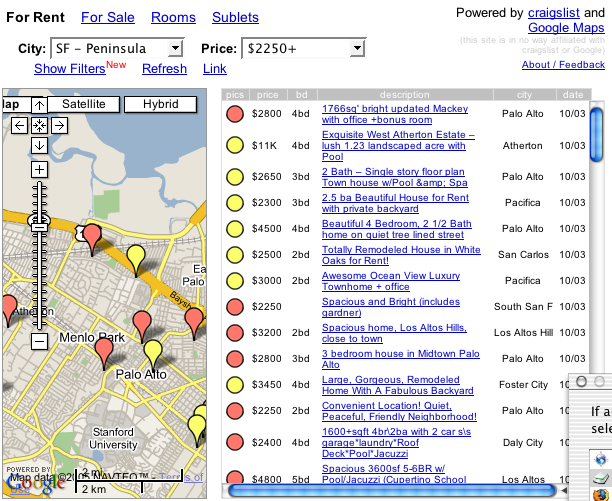

Housing Maps

the criagslist - googlemap mash up.

See also housing maps by census.

via

link paul k @inf greed

ex-Hip, ex Active Perl guy Dick Hartd now chases marrying privacy

and convenience in a single sign on.

And he appreciates fine cars, travel, and wine.

An excellent presentation at O'Reilly's Open Source 2005.

Bond Talk and commentary.

Delayed publication by four weeks for non-subscribers.

Beldar's legal review.

On Eliot Spitzer:

Whose job, as he views it, is to use the power of the State of New

York to enforce not "the law per se," but ... well, whatever he office whatever his keen insight perceives as being

damn well pleases whatever he thinks will get him elected to his next

target

within that broader, unwritten social compact. (Or maybe its

penumbras and eminations.)

techdirt is the thinking man's Slashdot. Better editing, thoughtful

exposition, all in the lead paragraph.

Previously: Alterslash is literally a better Slashdot.

Tightening aimed (indirectly, of course!) at asset bubbles will be

reversed, big time, if and when those bubbles pop.

This is the Greenspan Put !

-- Paul McCulley.

As explained at Pimco:

Put more technically, the value of the Greenspan Put will rise

exponentially if the curve inverts, while the cost of "buying"

that Put will actually become negative: in an inverted curve,

a duration-equal barbell of cash and long bonds yields more than

a bulleted portfolio. Such is the weirdness of an inverted curve:

the less volatile, convex barbell structure actually yields more

than the more volatile, less convex bullet. Rather than paying

for insurance, you get paid for taking it!

Roberts purports to rock: offers lawyer jokes

and doubts Michael Jackson.

macroblog looks at Shiller's claims of a housing bubble is about

about to burst.

Is the increase in housing indexes due to bigger, better houses,

or an genuine increase in the overall housing market ?

Housing price vs housing quality, now with quality control.

bubblemeter / David Jackson: yet another housing bubble blog.

Housing bubble trackers proliferate: here's six more.

NY housing bubble, NY

Property Grunt is NY-centric and offers a more commentary.

Jersey Shore, NJ

Boston, MA

Piggington, San Diego, CA

San Diego, CA

Seattle, WA

SoCal (CA)

Marin, CA

Well, you know, you have to remember that in every war, a battle plan

doesn't survive first contact with the enemy. This is in history. Why?

Because the enemy has a brain and they're constantly adapting, so we're

constantly adapting. Every time there's an adaptation, someone says,

"Oh, there's a mistake." It isn't a mistake. It's just reality. ...

Brad Sester's blog-portal of international and macro-economy.

politicaltheory offers a potpourri of headlines, from MSM, and think magazines.

Minimalist design.

Free headlines, subscriber-only content: *.

The HeyMath platform includes an online repository of questions,

indexed by concept and grade, so teachers can save time in devising

homework and tests. Because HeyMath material is accompanied by

animated lessons that students can do on their own online, it

provides for a lot of self-learning. Indeed, HeyMath, which has been

adopted by 35 of Singapore's 165 schools, also provides an online

tutor, based in India, to answer questions from students stuck on

homework.

[via NYT]

Altamont Press' RailRoad News and foamers' discussion.

History and trainspotting, mainline freight and commuter trains.

Seeking Alpha neatly ontologized money science into

* Exchange-Traded Funds (ETFs)

* Market Commentary

* China Investing

* Media Investing

* Digital Media Investing

* Stock Market Blogs

* Economics Blogs

* Venture Capital Blogs

* Personal Finance Blogs

and brings me Herb Morgan, Chief Investment Officer of Efficient Market

Advisors, on The Problem With Vanguard ETFs.

Roubini Global Economics Monitor:

Hedge funds: Measuring hedge funds' risk

Traditionally, economists have thought that big up-and-down

fluctuations in returns indicated risky investments, so many hedge

fund investors have hoped to see a pattern of smooth and even returns.

Andrew Lo quickly saw that lots of hedge funds were posting returns

that were just too smooth to be realistic. Digging deeper, he found

that funds with hard-to-appraise, illiquid investments - like real

estate or esoteric interest rate swaps - showed returns that were

particularly even. In those cases, he concluded, managers had no way

to measure their fluctuations, and simply assumed that their value was

going up steadily. The problem, unfortunately, is that those are

exactly the kinds of investments that can be subject to big losses in

a crisis. In 1998, investors retreated en masse from such investments.

Mr. Lo came to a disturbing conclusion: that smooth returns,

far from proving that hedge funds are safe, may be a warning

sign for the industry.

[NYT]

The Stalwart's interesting business coverage, such as:

What's Really Wrong With Dell ?, on the celebrity industry:

The Case For Paparazzi.

Also a real estate analysis.

Update 2009 May: Occasional co-author Vincent Fernando launches Research Reloaded.

Update 2008 October: now at Clusterstock.

Update 2008 August: Fluffy bits at Josephweisenthal.com.

Update: Less frequent after spring of 2006, but came back in April 2007.

Also, 2007 August, was guesting at TechDirt.

Length of stay (LOS) is an important measure of hospital activity and

health care utilization, but its empirical distribution is often

positively skewed.

Median regression appears to be a suitable alternative to analyze

the clustered and positively skewed LOS, without transforming and

trimming the data arbitrarily.

Objective. This study reviews the mean and median regression

approaches for analyzing LOS, which have implications for service

planning, resource allocation, and bed utilization.

Methods. The two approaches are applied to analyze hospital discharge

data on cesarean delivery. Both models adjust for patient and

health-related characteristics, and for the dependency of LOS outcomes

nested within hospitals. The estimation methods are also compared in a

simulation study.

Results. For the empirical application, the mean regression results

are somewhat sensitive to the magnitude of trimming chosen. The

identified factors from median regression, namely number of diagnoses,

number of procedures, and payment classification, are robust to

high-LOS outliers. The simulation experiment shows that median

regression can outperform mean regression even when the response

variable is moderately positively skewed.

Conclusion. Median regression appears to be a suitable alternative to

analyze the clustered and positively skewed LOS, without transforming

and trimming the data arbitrarily.

Analyzing Hospital Length of Stay: Mean or Median Regression ?

Medical Care. 41(5):681-686, May 2003.

Lee, Andy H.; Fung, Wing K.; Fu, Bo

[**]

Daniel Gross, economic commentator, is consumer-centric

and a left-leaning fact checker

Mimi in New York is a bitter trustafarian flirt.

findarticles is the poor man's Lexis/Nexis.

Can't find it there ? Try MozBot instead.

Lyn Nofziger posts crusty musings.

Track home builders' stock.

Toll Brothers Inc. (TOL)

KB Home (KBH)

Pulte Homes Inc. (PHM)

DR Horton Inc. (DHI)

KB Home (KBH)

Hovnanian Enterprises Inc. (HOV)

New read Margin Call.

LIBOR (London Inter-Bank Offered Rate) is based on rates that

contributor banks in London offer each other for inter-bank

deposits.

From a bank's perspective, deposits are simply funds that are

loaned to them. So in effect, a LIBOR is a rate at which a

fellow London bank can borrow money from other banks. Rate

calculations incorporate variables such as time, maturity

and currency rates. There are hundreds of LIBOR rates reported

each month in numerous currencies.

Examples: the 1 Year LIBOR as published monthly by Fannie

Mae: rate history.