Climateer Invest

Climateerinvest is newly blogrolled.

Climateerinvest is newly blogrolled.

Clusterstock advances to the top of our blogroll,

with three top business and economic writers:

Henry,

Carney (Update 2011: Carney now at NetNet but still worth reading) (Best of: After our experience with Hank Paulson as Treasury Secretary, there was a great feeling among the masses that what we needed was not a chief executive running the economy, much less a Wall Street boss. What we needed, nearly everyone said, was a smart guy who came from outside the corporate boardroom. And that's what we got in Geithner.),

and Stalwart (John Paulson shares his Economic Crisis Stories At Recovery.Gov).

Bronte Capital on Wachovia's quest for deposits and on WaMu 'this is not a credit driven crisis. It's a funding driven crisis'.

Aleph blog explains covered bonds, proposed to save the mortgage market.

It is not a passthrough, it is a bond. The covered bond buyers do not receive the principal and interest from the security held by the bank, the bank receives it. The covered bondholder (in absence of default) receives timely payment of interest at the stated rate, and principal at maturity. Only in default does the value of the security for collateral matter. If the collateral is insufficient to pay off principal and interest, the covered bondholders are general creditors for the difference.

Chris Whalen @ PRMIA, (archives).

Example:

There is nothing you can do to "fix" a CDO, to make it liquid,

other than to standardize the terms and trade it on an exchange.

The liquidity gridlock prevailing in the secondary market for CDOs

is the normal situation for such unique and entirely opaque

instruments, whereas the past illusion of liquidity was abnormal,

a byproduct of the "irrational exuberance" described by Greenspan

himself. Buy Side investors accepted the fallacy of liquidity -- until

they asked the Sell Side dealers to bid on the paper. That's when

the current trouble really began.

epicureandealmaker on fat tails.

Derivatives: Transfering risk or reducing risk ?

Accrued Interest aka accruedint, smart about finance and economics.

Why Home Depot should borrow more.

economist freeexchange economics and public policy.

Adverse selection in healthcare, about inequality.

Examples:

Why we lie.

*

tribute to Montreal.

Housingderivatives tracks futures and options in housing prices.

CreditSlips covers consumer lending from an

aspiring consumer protectionist regulator perspective.

Generally well informed and level headed:

debt trading,

Consuming is where consumers feel in control

(compare to John Fiske, "Shopping for Pleasure: Malls, Power & Resistance").

Innumerate: one number represents the whole population ?

Zillow, the real estate mapper, blogs.

And Zillow adds new real estate mapping and data services,

drive-by appraisal via SMS.

See also Trulia.

Update 2008 October: Henry's Clusterstock is now a must read.

Update 2008 August: Now at (Silicon) Alley Insider.

Example: Can Google make subscription revenue ?

The over-maligned, persuasive Henry Blodget, now at Cherry

Hill Research.

Update 2007 August: Also posting at HuffPo.

Chief Officer: CXO advisory.

Management Science digest.

Footnoted reads SEC filings, Edgar's fine print.

Corporate law and governance are topics of Ideoblog Ribstein. Examples:

Gretchen Morgenson on corporate governance, the state's role in changing corporate contracts.

Value of naming rights: Instead of Goldman Sachs, why not

Goldman Sacks by Smirnoff Ice ? Indeed.

Long or short capital offers mockery for the investing class.

Coruscation would like Goldman Buffett Sachs by Saks Fifth Ave and Broad Street.

Leveraged Sellout's entertaining life around Wall Street.

Private equity: Going Private gives catty take downs of

Guy Kawasaki and Maverick Mark Cuban.

Update 2009 January: On Barry 0, vs Chicago School of Economics 1.

Confesses to physics on Dealbreaker.

Nouriel Roubini's first rate economics blog offers an

essay of macroeconomic commentary about weekly.

Quick off the mark with commentary on new Fed Chairman

nominee on Ben Bernanke.

Previously: Roubini Global Economics.

Brad Sester's blog-portal of international and macro-economy.

Seeking Alpha neatly ontologized money science into

* Exchange-Traded Funds (ETFs)

* Market Commentary

* China Investing

* Media Investing

* Digital Media Investing

* Stock Market Blogs

* Economics Blogs

* Venture Capital Blogs

* Personal Finance Blogs

and brings me Herb Morgan, Chief Investment Officer of Efficient Market

Advisors, on The Problem With Vanguard ETFs.

The Stalwart's interesting business coverage, such as:

What's Really Wrong With Dell ?, on the celebrity industry:

The Case For Paparazzi.

Also a real estate analysis.

Update 2009 May: Occasional co-author Vincent Fernando launches Research Reloaded.

Update 2008 October: now at Clusterstock.

Update 2008 August: Fluffy bits at Josephweisenthal.com.

Update: Less frequent after spring of 2006, but came back in April 2007.

Also, 2007 August, was guesting at TechDirt.

Econbrowser, time series economist looks a current economic, investment

and business news.

Paul Kedrosky / Infectious Greed

Technology aware musings on money culture, with a keen eye

for interesting or jarring research. Great weekend reading.

y the executive director of the William J. von Liebig Center for Entrepreneurism

and Technology Advancement at the University of California, San Diego.

Sarong Party Girl, sarongpartygirl.

Update 2009: moved to Babelogic and learned to draw.

New Yorker, car fan, and economist Barry Ritholtz's Big Picture, a well presented

peresonal economic journal. Sample article, Homeowners Go Deep in Debt to Buy

Real Estate.

Also writes as Amateur Investor columnist at The Street / Real Money.

Update 2008 Noverber: Now at Ritholtz.com: example.

Radar O'Reilly buzzes social and open source software, with a

smattering of user empathy.

Another group blog.

Statistical Modeling, Causal Inference, and Social Science (MLM)

Andrew Gelman and Samantha Cook at Columbia.

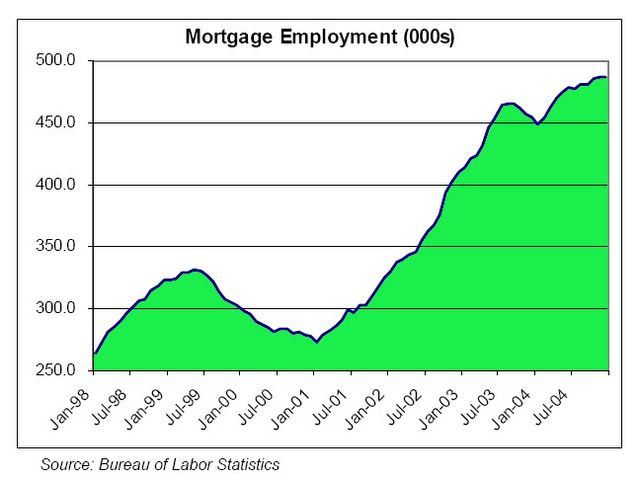

Calculated Risk offers nicely illustrated economics.

There has been a significant increase in mortgage brokers. There

has been a similar increase in residential building trades, appraisers,

home inspectors and other housing related occupations. The

impact of a housing slowdown on employment will be significant.

What will the end of the refinance boom and the housing boom

do to the mortgage industry ?

housingbubble, moderately frequent. not to be confused with

thehousingbubble. Both track home of those who over finance,

over mortgage their real estate.

AutoBlogging Friday compared dreamy showcars vs dreary their

production descendants.

Case in point: the Subaru Re1.

37signals' Signals vs Noise blog fora.

Web design, and designers' culture.

Smart interaction design. Channel svn.

Belgravia Dispatch, longer articles, internationally minded.

Mahalanobis is Michael Stastny's excellent economics blog.

He also has a sharp eye for current events, and bio'ed on Xing.

Belmont Club. History and history in the making. (archives).